Here we go again. The “B” word.

The property market seems to have stabilized in recent months.

So we thought we were done for a while with fears about a housing “bubble”. No such luck. I’m not going to argue that the market is “cheap”. It’s not. Some might even argue it’s getting expensive.

While property prices may not be screaming bargains, it’s irresponsible to say we’re in a bubble.

But an announcement last week by the Bank of England means the number of residential homebuyers able to borrow more than 4.5 times their income will be restricted.

This was hailed as an important “insurance policy” to curb another property bubble.

So what was this new move designed to prevent the housing market from overheating at some point in the future rather than using a fire extinguisher to put out all the flames of activity now?

The Bank’s Financial Policy Committee (FPC) key recommendations were to prevent the UK market getting out of control and to stop the vast majority of borrowers getting into unsustainable debt.

In particularly:

- Lenders insuring mortgage applicants can cope with a 3% point rise in interest rates

- Limit risky lending by putting a 15% cap (of the banks mortgages) on the number of mortgages banks & building societies can give to borrowers wanting to raise more than 4.5times their income

- Banning any borrower for applying for a loan through the Help To Buy scheme more than 4.5 times their income

When will these changes take effect?

The changes which limit the number of mortgages completed, rather than their total value from October 1st 2014.

Are all residential lenders affected?

No, only lenders which advance funds worth more than £100m a year: so smaller banks will be exempt from the new changes.

Which types of borrower will this impact?

Niche borrowers who depend on a higher loan to value of 4.5 times plus their income. Those around London & the South East where property prices are higher than the national average.

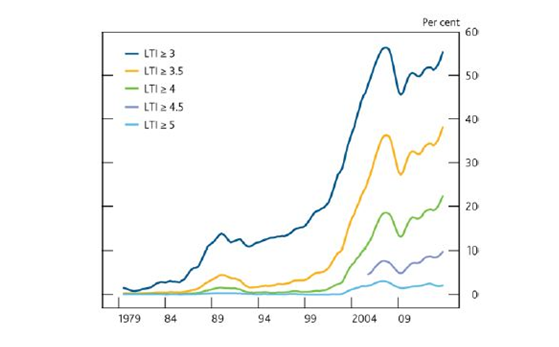

The below graph shows new mortgages for house purchases by loan-to-income ratio:

What if I want to remortgage and already have a loan at 4.5 times income or above?

Quite simply, if you want to remortgage and don’t want to gear to a higher [new] amount, you will not be impacted by the new rules.

The 15% limit will be considered if you want to borrow a higher loan-to-income ratio when considering a new application.

Will this impact buy to let?

No.

What is the new stress test?

Major banks have been advised to “stress test” the borrowers’ ability to repay the loan over a 5 year period if interest rates was to rise by 3%.

For example, a borrower taking out a mortgage at 4.5% would need to afford the repayments at a rate of 7.5%.

Is this different to the current stress test?

Slightly. Lenders are typically stress testing at a rate between 6-7% so the effect of the new proposals will be a little.

Are we in a run-up to a bubble?

During the last bubble, house prices sky rocketed, doubling in many markets in just a few years. So much, many quit their jobs to flip houses. Banks, government and household balance sheets swelled very quickly You may remember the media frenzy?

Buying and selling became the UK’s pastime. A lot of ordinary people became very wealthy after buying, refurbishing and selling (BRS). I guess it also helped that lenders were pushing down 125% mortgages – no documents-no-job-required loans.

Today’s market is very different. ‘But Mark, if the market isn’t cheap and property has been rising for a while, then clearly it must be a property bubble?”

The next time you hear someone mention the bubble word, remember the last few property bubbles. Higher prices were accompanied by a greed- fuelled frenzy, something not apparent today, despite the headlines.

When cabbies start talking about property again + offering property tips …when ordinary people start quitting their jobs to trade property…that’s when it will be a property bubble.

At the moment….

The housing myth is indeed that…just a myth.

We’ve see this story play out before.

Is this new policy premature?

In the past, the “players” were ordinary folk who got caught up in the euphoria and became addicted to the gambling, something which is unlikely to happen in the near-to-distant future.

And I haven’t had a cab driver talk to me about property in 5 years, which says something.