Following from the success, empowering &inspiring first day, day 2 of the Property SuperConference was kicked off by Rob and Father- daughter duo, Francis & Emily Dolley..

‘Multi-let Without the Sweat’ is a niche little strategy which involves finding a tired landlord or someone struggling to rent their property & offering them a ‘guaranteed rent’ for a fixed term at below market rent & multi-letting the rooms at market value& keeping the difference. Usually this would involve setting up a managing agreement & positioning yourself as a letting agent, keeping the surplus cashflow as your management fee.

This concept is great for a few reasons: You don’t need a mortgage, a deposit, high refurbishment outlay, or planning permission, as you will be taking over established HMO’s & making between £500-900 pcm.

Who wants a piece of that cake?!

Whilst on second stage, Mark & Trevor Cutmore were delivering No Mortgage, No Deposit, 2012 Cash flow Investing Techniques..

.. This was a fantastic section for those Investors who couldn’t get mortgages, didn’t have money for deposits and were able to make between £200-£400 pcm per deal using lease option & instalment contract strategies.

We were fortunate to have Trevor Cutmore, sharing his experiences once again, tailing off the back end of the Progressive training, showing how he is attainted over £30k per year passive income from his residential and Option portfolio. Trevor was a Progressive student and is now head LO trainer at Progressive because of his fantastic knowledge and amazing results. He is now buying more than we are at Progressive!

Recovering from a short power networking break, Rob went into detail about finding your local goldmine area.

In simple terms, a Goldmine investing area = locality + tenant demand + volume of discounted stock + 8.5% plus yield

Rob went into detailed specifics on the CASTLED model when researching your micro areas (This is pure gold in the right hands…)

Ok, let’s take a look…

C.ashflow – Not treating your property acquisitions as a business is a recipe for disaster.We know the old adage that cash flow is king and without a healthy flow of cash you won’t have a business period.

Tip: Look at micro areas with the highest yield & return.

Remember – the ‘number of properties you own is vanity, the cash flow you make is sanity and the cash you have in the bank is reality’

A.menities – The availability and accessibility to local amenities and facilities such as local transport links, employment opportunities, local businesses, retail parks, supermarkets, schools and colleges, will ensure your investment has strong tenant demand & the highest capital growth potential.

S.upply – Ensure properties in your micro-area have the strongest (and fastest growing) level oftenant demand relative to the supply of properties of that type

T.enants – A simple thing you can do to check high tenant demand in an area is to put an advert in the local paper for a property which you propose to buy

(could just be a general ad in the classifieds)

List the type of property and the rent and put your mobile as the contact. Gauge how many calls You get and monitor the number of enquires. Clearly lots of calls means that it is likely to be a reat area, none means that there may be low tenant demand!

Your risk is vastly reduced as you know whether it will rent BEFORE you make the decision to purchase. Also check LHA waiting lists in your area.

L.ocal – Not only does buying in a tight local area allow you to understand exactly what the tenantdemand is, but it also ensures you understand the price of the local stock inside out and (this isthe big one) you can manage them properly jumping on voids, high maintenance or bad debt.. all things, which left unchecked, can really hurt you.

E.xisting – You will focus better on 1 or 2 property types in an area, say EXISTING 2 or 3bed terraced houses, as you will likely end up knowing the prices better than the surveyors, agents, vendors & investors. This means when something is priced cheap, you’ll be able to spot it right away whilst others don’t.

D.iscounts- By getting a good level of discounted properties whilst ensuring a number of greater comparable units are selling at open market values, you’ve got instant equity and a buffer if property prices were to fall further. It also allows you to Remortgage and remove your initial deposit as soon as circumstances allow, thereby significantly reducing the risk of losing money in the short term, as you will have left none of your own money in. 0% risk on funds, infinite ROI.

We’ve never previously revealed the CASTLED model (except for our LIVE presentation at the PPSC) so we hope it helps you get the highest ROI in your goldmine area

Simon Zutshi was delivering some golden nuggets on second stage on making great returns flipping deals that didn’t fit your investment strategy or had little or no equity. This was insightful to say the least.

Next we had Mark detailing another investment strategy that we are utilising very much in the current climate that we’ve never shared before – Title Splitting or otherwise known as Buy One Get One Free (BOGOF).

This is very specific sexy strategy which involves buying a property & developing it into self contained flats, creating separate titles & separate leases. There’s often a large gap between the value of a house and what it might fetch converted to flats.

The flats , combined are worth more than the value of the houses on its own. We recently purchased a property for £185,000 (15% UMV)& developed them into 4 self contained flats, total value after refurb £415,000 & generating £880 NET cashflow pcm.

This talk was definitely an eye-opener for some: taking such a simple strategy & exploiting it to its core in terms of cash flow & uplifted value

Next we had the UK’s leading authority on LHA, Mike Frisby sharing his cashflow nuggets especially his 2 + 2 strategy which we never heard of – this was a fantastic section & Mark was certainly implementing these tricks the next day for our properties let to LHA tenants..

We had the crazy Austrian& Brand Expert, Daniel Wagner revealing his “Expert Success Formula”..

Imagine what it would feel like Right now to be BOLD and turn your dreams into reality… Work when you want, where you want, and how you want. No more alarm clocks ringing at some ungodly hour every morning, each weekday, no more struggling to work, squeezing through bumper traffic, underpaid, unfulfilling work for 40-60hours a week [or more] for the rest of your life…

Daniel was absolutely mind-blowing. Now was the time to turn your life around, cash in and develop your niche area of property investing & brand so you can teach and build your portfolio & generate income, and leverage yourself as a brand expert.

What was even more powerful was that he was actually doing it LIVE, teaching you how to influence and get people to buy your products, while doing it!

Inspirational to say the least

Lastly, Rob held the audience with his spellbound skills in the advanced bare knuckle negotiation section.

A truly gritty and practical segment from Rob, with a no BS, underground presentation you wouldn’t want everyone knowing, especially estate agents and vendors – his ‘sudden change of behaviour’ technique was extremely powerful.

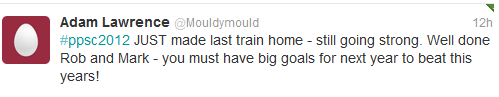

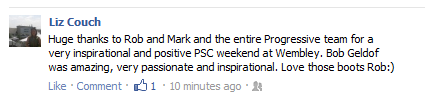

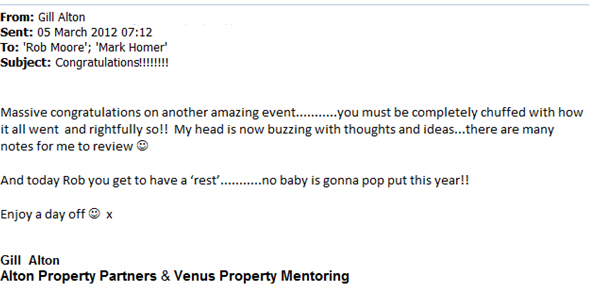

To end a fantastic start to a great day, we donated over £28,000 to Cancer Research (topped up by Rob & Mark to £30k)- Thank you for those who joined us last making the 2012 Progressive Property SuperConference the most amazing yet.

We are all looking forward to next year already