There is an industry that’s outperformed nearly any other asset class you could imagine.

Cash… Left in the dust.

UK government bonds… Not even close.

Equities… Nope.

UK commercial property… Yup, beat that too.

Stocks… Indeed.

Answer?

Buy to let of course.

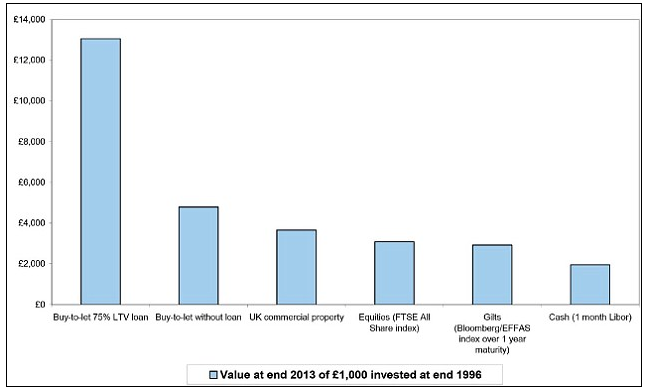

Interesting research emerged from the buy to let lender Paragon about returns on buy to let since 1996 when the market really got going post the Housing Act. The typical return for a landlord that geared (borrowed money using a mortgage) over this period has been 1200% in 18 years. The 2 things that made the difference were clear:

1) Being in it for the long term

2) Using borrowed money such as a mortgage at 75% to increase the return

On an annualised basis taking out the effects of compounding this is a 13% return. Over the same period average annual returns from cash were cash 4%, commercial property 7.9%, Shares 6.8%, bonds 6.5% which is quite startling when looked at in those terms.

Comparably a investor buying properties cash (without a mortgage) would have a total return of £4791 from investing a £1000 over the same period, which is just under 2/3 less

The point is that the buy to let investor would have multiple properties by the end of the investment period with the same capital injection Vs. the cash investor having just one.

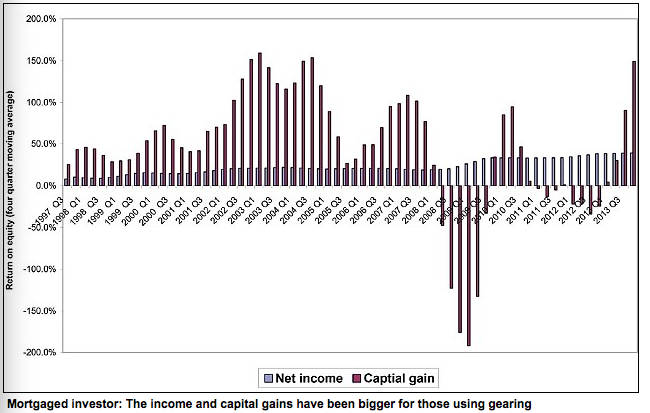

Now its important to understand that we should all invest with income being the focus knowing that capital gains are a secondary benefit. The reality is that the capital side of the investment return is much juicer over the long term though and is where the most significant increases in your return are likely to come from – its just impossible to predict when and how much growth this will be and importantly it dosen’t pay the mortgage or the bills.

Another really interesting graph is below. The person who remortgaged back up to 75% when prices rose to buy more properties has done even better. Whilst you should be concerned with not over gearing and you may want to fix your interest rate if taking on higher levels of debt the historical returns from this strategy are pretty compelling:

Obviously gearing works both ways: When a crash comes as it did in 2008 (and will come again perhaps in another 10-15 years) your losses are amplified so its important to keep cash aside and focus on keeping your properties well managed and rented to pay the mortgages so you aren’t forced to sell them at the wrong time.

But the long term picture is clear, mortgaged buy to let properties have produced a vastly superior return over the last 18 years vs. investors who bought with cash